1. Avoid unsecured loans if possible

2. Be clear about leasing

3. Be honest in loan applications

4. Can't get a standard loan? There are alternatives

5. Check your statements for errors

6. Consider smaller lenders too

7. Do you have to take out a personal loan at all

8. Do you qualify for a 'relationship discount'?

9. Don't just take the dealer finance

10. Don't make multiple applications

11. Don't rely solely on comparison rates

12. Have the right information when applying

13. Have you considered a credit card?

14. Honesty counts

15. Keep accurate records

16. Know what interest rate applies

17. Look beyond the banks

18. Try lenders with whom you are a regular customer

19. Understand what's on offer

1. Avoid unsecured loans if possible

1. Avoid unsecured loans if possibleAvoid using unsecured personal loans if you can put up some security for your borrowings. This will get you a lower interest rate. A home equity loan, or redraw of extra repayments, allowing you to borrow against the equity built up in your own home or an investment property, is the best option of all, and could get you finance at up to 5 percent less than a car loan.

2. Be clear about leasingLeasing is really just another form of borrowing to finance a car. But unlike loan finance - where you take ownership of the car and offer it or something else as security to the lender – lease finance sees a leasing company take ownership and give you the use of the car under contract for a specified period.

3. Be honest in loan applicationsBe honest about why you want the loan. Your bank may be able to offer you a loan option that better suits your circumstances. There are an increasing variety of different types of personal credit these days; car loans, commercial loans, leases, home equity loans, are just some of the examples.

4. Can't get a standard loan? There are alternativesIf the banks, building societies and credit unions won't lend to you because you're self employed, newly arrived in the country or have a poor credit history, consider the booming non-conforming and "low doc" loan market. A number of non-bank lenders offer loans which especially cater for this type of borrower. The interest rates on non-conforming loans are generally higher but come down after a few years of on-time repayments.

Compare non-conforming and low doc loans.

5. Check your statements for errorsThere are claims that more than 50 percent of home loan statements contain calculation errors. Simple mistakes, like the entry of the incorrect balance or the application of the wrong interest rate at the wrong time can be costly and mostly favour the lender. We all make mistakes, even bank computers make them and that's why borrowers should keep a close eye on loan statements. Various software for your home PC is available that can run a check on your statements.

6. Consider smaller lenders tooWhen shopping around for a car loan, consider community banks, credit unions and other smaller financial institutions which might be more approachable, and offer lower interest too.

7. Do you have to take out a personal loan at allThink twice before borrowing money without security. You may have a better option already available; home equity extension to your home loan, a new loan that uses your property as security, a credit card, or even a rich relative.

8. Do you qualify for a 'relationship discount'?Relationship discounts are available from banks and credit unions for those borrowers who consolidate a range of banking business with the one institution. Home and personal loan interest rate discounts, term deposit bonuses, savings account fee waivers and credit card annual fee waivers are commonly offered.

9. Don't just take the dealer financeDon’t accept loan or lease finance offered by a car dealer before comparing the offer with finance options offered by your bank or other credit providers. Dealer finance might be less hassle but you could well end up with an expensive loan and more restrictive terms and conditions. The same goes when buying furniture or any consumer goods where finance terms are offered.

10. Don't make multiple applicationsDon’t fill out applications at several financial institutions and have all of them checking into your credit history. This can make you look desperate and lower your credit score.

11. Don't rely solely on comparison rates

11. Don't rely solely on comparison ratesAll lenders must now include "comparison rates" in advertisements for their home loans and personal loans to help consumers get a feel for their total cost - fees and the interest. Don't rely solely on comparison rates when choosing a loan and beware of their shortcomings. They only take into account fees and interest rates, not the features and how suitable the loan is for your circumstances.

12. Have the right information when applyingWhat you will be required to supply in any application for lease finance will depend on whether the lease is for personal or business use.

Personal lease applications will require:

* proof of current employment

* income details or tax returns

Business lease financing requires more detailed information and may include your:

* balance sheet

* tax returns

* cash flow projections

* business plan

Confirm with the lender what you will need before the interview.

13. Have you considered a credit card?Consider also a credit card as your source of credit. Interest rates are generally higher but credit cards are easier to secure and offer greater flexibility of repayments.

Check out BankChoice's credit card selector to compare cards that suit your needs.

14. Honesty countsBe honest about why you want the loan. Your bank may be able to offer you a loan option that better suits your circumstances. There are an increasing variety of different types of personal credit these days; car loans, commercial loans, leases, home equity loans, are just some of the examples.

15. Keep accurate recordsKeep accurate records of your deposits and ATM transactions. It is also wise to keep copies of your loan application and approval documents in a safe place.

This is the best way to avoid hefty fees which may be charged by a bank when its customers want to see copies of their cheques or loan files.

16. Know what interest rate appliesWhen offered car finance, either lease or loan, always be sure you know what interest rate applies. Lenders often ‘sell’ you their finance packages by quoting the monthly repayments only. This may disguise a high interest rate.

17. Look beyond the banksGet a feel for what's on offer across the wide range of financial providers around these days. Credit unions, building societies, mortgage originators, community banks and boutique online or telephone banks may offer better interest rates or lower fees than the big banks because they are anxious to win new business or they are non-profit organisations.

18. Try lenders with whom you are a regular customerTake advantage of the human factor. Being a familiar face may earn you some slack if your credit background is smudged.

19. Understand what's on offerIs the interest rate fixed or variable? What up-front, annual or ongoing fees are charged? Check out BankChoice's loan selector to compare loan fees and rates.

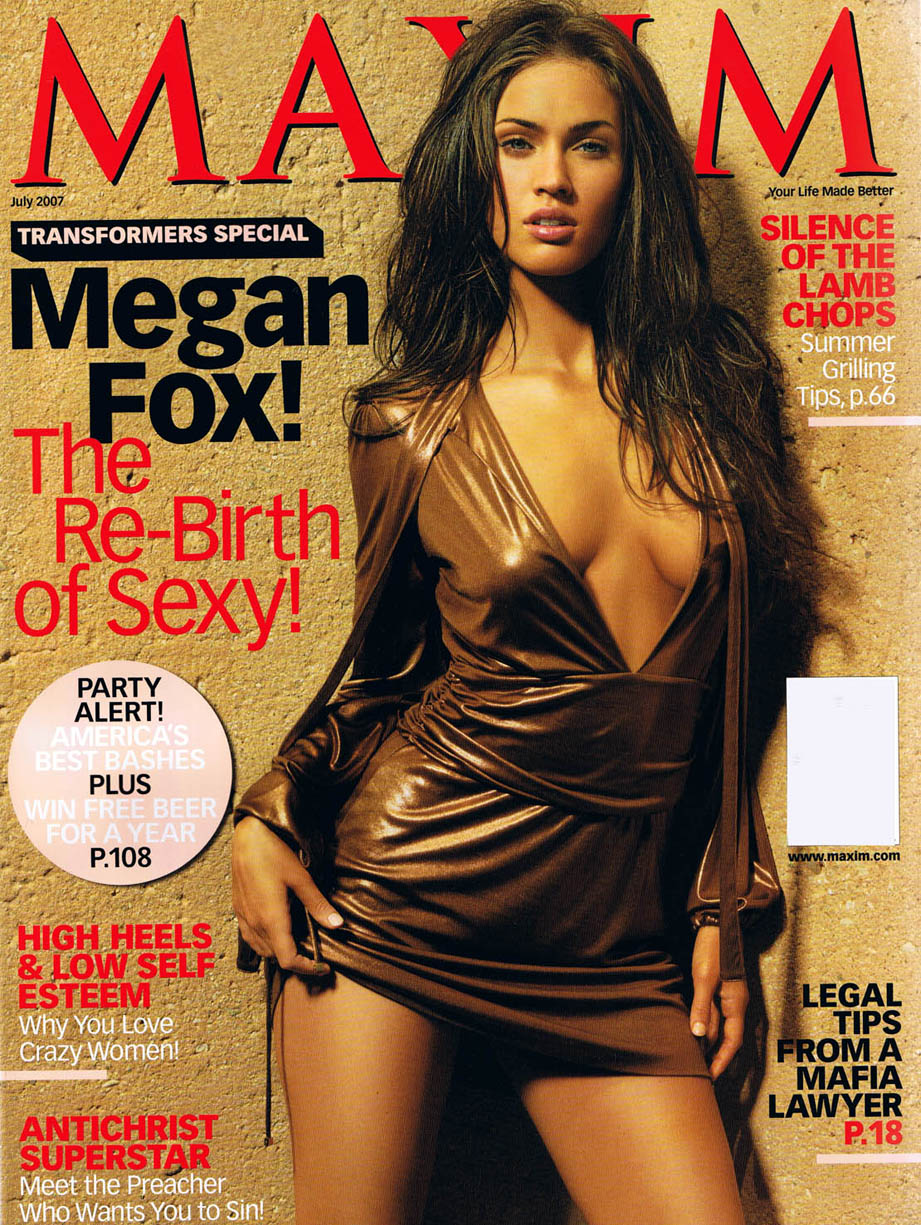

A bikini or two-piece is a type of women's swimsuit, characterized by two separate parts — one covering the breasts the other the groin (and optionally the buttocks), leaving an uncovered area between the two garments. It is often worn in hot weather or while swimming. The shapes of both parts of a bikini closely resemble women's underwear, and the lower part of a bikini can therefore range from the more revealing thong and modest square-cut shorts.

A bikini or two-piece is a type of women's swimsuit, characterized by two separate parts — one covering the breasts the other the groin (and optionally the buttocks), leaving an uncovered area between the two garments. It is often worn in hot weather or while swimming. The shapes of both parts of a bikini closely resemble women's underwear, and the lower part of a bikini can therefore range from the more revealing thong and modest square-cut shorts.